SAVINGS

Earn more for your home security business by partnering with Alert 360 authorized alarm dealer program. Our goal is to provide our partners with high pay, elite products & services and programs to take your business to the next level.

INNOVATION

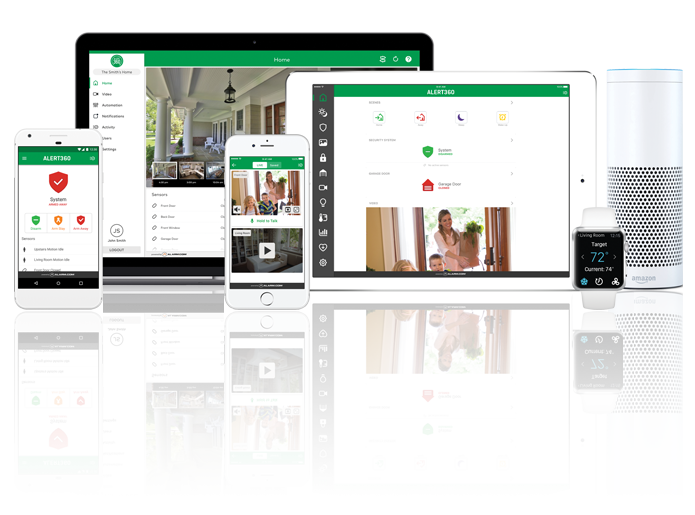

We offer the most advanced security/automation products and services to our customers. By having access to best and greatest offerings, you’ll be primed to beat out the competition.

RELIABILITY

Get paid on time, every time. With weekly reliable alarm funding and support, you can have the confidence to grow your business as an Alert 360 Authorized Dealer.

Advantages of working with Alert 360

Authorized Alarm Dealers

- Competitive multiples

- No holdback

- No UCC Lien

- Weekly reliable funding

- Non-exclusive agreement

- 3 payment guarantee

- 90-day service guarantee

- Aggressive equipment discounts and rebate program

- Leading edge technology

- Exclusive Alert 360 Video program & app

- Dedicated support

Bulk & Partial Acquisitions

- Comprehensive alarm company valuations

- Competitive multiples

- Flexible purchase options

- Transactions of all sizes

- In-House due diligence

- Expedited closings

- Continued revenue from service, equipment add-ons, and referrals

Give us just 10 minutes to explain why

Alert 360 dealers  us.

us.

Dealer Program: 888.848.8851

Portfolio Acquisitions: 888.885.8656

Here’s what some of our alarm dealers say:

“We have been an Alert 360 security dealer for almost 11 years. Their team is extremely helpful and professional, they’re a great company to do business with. Having real industry experience, they understand what to look for to help our business continue to reach new heights.”

Alert 360 Dealer

since 2008

Dallas, TX

“We’ve been an Alert 360 dealer for nearly 20 years and they’ve been a tremendous alarm partner. They always provide timely and accurate funding and always stayed true to their word. More importantly, they have always taken extremely good care of our customers. Alert 360 has proven to be the best partner for us and we’re proud to be associated with them.”

Alert 360 Dealer

since 2001

Oklahoma City, OK

“Our experience with being an Alert 360 security dealer the past 15 years has been wonderful. Their funding cycle is fast and reliable and they truly care about the dealer’s success. With 22 years alarm industry and experience with other programs, I’ve found that Alert 360 does not compete with its dealers and strives to help them grow and be successful every step of the way. Whether you’re new to the industry or looking to switch programs, Alert 360 is the way to go!”

Alert 360 Dealer

since 2003

Nashville, TN

A PROMISE FROM ALERT 360 CEO

Richard Ginsburg

“Along with the entire family of Alert 360 employees, I promise if you join our security dealer program or simply sell accounts to us, we will ensure you have a competitive advantage in the marketplace and peace of mind that your customers will be taken care of.”

GET STARTED NOWTechnology Partners

We are partnered with the industries leading technology companies to offer cutting edge products and innovative solutions.